How to Read Forex Market Structure Like a Professional Trader

Introduction

When beginners first look at a forex chart, it often feels overwhelming. Candles move quickly, prices change every second, and it becomes difficult to understand what the market is actually doing. Because of this confusion, many traders add indicators hoping they will make things clearer.

In reality, price itself already tells the full story. The way price moves over time is known as market structure. Market structure helps traders understand whether buying activity is pushing prices higher, selling pressure is driving prices lower, or if the market is simply moving without a clear direction.

This article explains forex market structure in a simple and practical way. You do not need advanced knowledge or technical tools. If you can observe price moving up and down on a chart, you can learn how to read market structure step by step.

What Market Structure Means in Forex

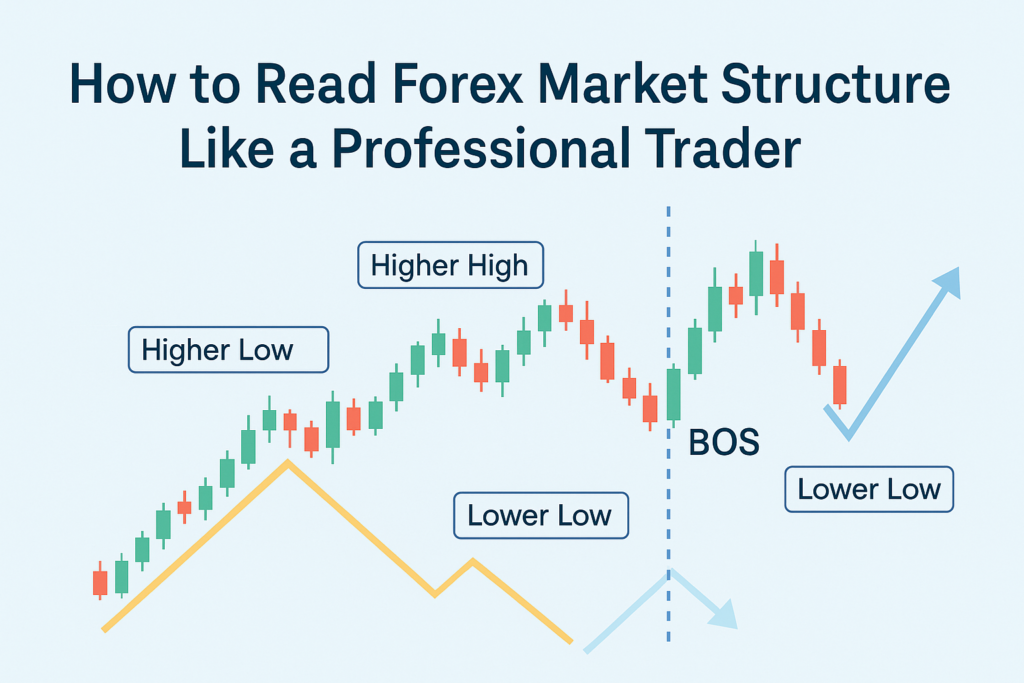

Market structure refers to the pattern created by price movement. Price does not move randomly. It reacts to buying and selling pressure, forming visible movements on the chart.

At any point, price will generally be doing one of three things:

- Gradually moving higher

- Gradually moving lower

- Moving back and forth within a limited area

By studying how price creates swing points, traders can understand the current market condition and avoid trading blindly.

Professional traders always focus on market structure before placing any trade.

Understanding an Upward Market

An upward market forms when buyers consistently control price movement. Instead of moving straight up, price climbs in stages.

In this type of market:

- Price pushes upward

- Small pullbacks occur

- These pullbacks stop early

- Price continues rising afterward

This behavior shows that buyers are comfortable paying higher prices. As long as price continues to progress in this manner, the upward direction remains valid.

Experienced traders look for buying opportunities during pullbacks rather than chasing price after strong upward moves.

Understanding a Downward Market

A downward market appears when selling pressure dominates buying interest. Price moves lower gradually, not suddenly.

In this situation:

- Price declines to new levels

- Small recovery attempts appear

- Those recovery moves lose strength

- Price continues moving lower

This behavior shows that sellers are willing to accept lower prices, while buyers struggle to regain control.

Professional traders prefer selling during brief upward pauses instead of buying simply because price looks cheap.

When the Market Moves Sideways

Sometimes the market does not move clearly higher or lower. Instead, price fluctuates within a defined zone.

In a sideways market:

- Price stays between upper and lower boundaries

- Direction remains unclear

- Breakouts often fail

Many beginners lose money during these periods because they expect strong trends that never develop. Experienced traders either trade carefully near the boundaries or wait until price shows clear direction.

If price repeatedly returns to the same levels, the market is likely ranging.

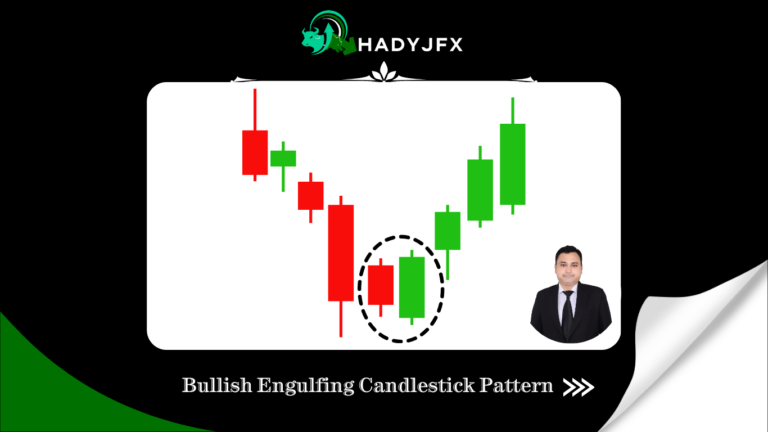

Understanding Changes in Market Behavior

A structural change happens when price stops behaving the way it did before.

For example:

- An upward market suddenly starts falling deeper than usual

- A downward market unexpectedly pushes higher

These changes suggest that control may be shifting. However, they do not automatically confirm a full trend reversal.

Professional traders observe how price reacts after such changes before making decisions.

When a True Trend Change Occurs

A genuine change in direction develops over time.

An upward market begins turning downward when:

- Price struggles to continue higher

- A key support area fails

- Recovery attempts lose strength

- Price starts forming lower levels

This sequence indicates that buying pressure is weakening and selling interest is increasing.

Experienced traders wait for this confirmation before changing their trading bias.

Pullbacks vs Direction Changes

One of the most common beginner mistakes is confusing temporary pauses with full reversals.

A pullback is a short pause or retracement before price continues in the same direction.

A reversal is when price completely changes its behavior and starts moving the opposite way.

A simple rule helps here:

If price continues respecting its recent structure, the main direction is still active.

Why Multiple Timeframes Matter

Professional traders do not rely on only one timeframe.

They usually:

- Observe higher timeframes to understand the overall picture

- Use lower timeframes to find better entry points

For example, if price shows consistent upward movement on a higher timeframe, traders avoid selling on lower timeframes.

This approach helps traders stay aligned with stronger market forces.

Why Market Structure Works Without Indicators

Market structure relies entirely on price behavior. It shows what is happening in real time.

Indicators calculate values from past data and often respond late. Market structure reflects current buying and selling activity directly.

This is why many professional traders prefer clean charts with minimal or no indicators.

Common Mistakes Beginners Make

Many beginners struggle because they:

- Trade without understanding market direction

- Enter trades without waiting for clarity

- Ignore the bigger picture

- Trade during unclear market conditions

- Act emotionally instead of logically

Avoiding these mistakes can improve consistency more than adding new strategies.

How to Practice Market Structure

Learning market structure requires observation and patience.

A simple practice approach includes:

- Removing indicators from charts

- Marking important price swings

- Watching how price reacts near previous levels

- Studying how trends begin and end

- Writing down observations

With regular practice, price behavior becomes easier to read.

Conclusion

Market structure is the foundation of smart forex trading. It helps traders understand who controls the market and what price is likely to do next. By learning how price moves, pauses, and changes direction, trading becomes calmer and more logical.

You do not need complex systems or advanced tools. Understanding price movement alone can greatly improve decision-making. When you trade with market structure, you follow the market instead of fighting it.

Market structure is not complicated. It is simply learning to read what price is already showing.

Visit our Social media pages:

https://www.instagram.com/hadyjfx_official/

https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

Join our free telegram channel:

https://t.me/hadyjfx