How to Build a Profitable Forex Trading Strategy from Scratch (Complete Guide)

A Complete Step-by-Step Guide for Traders

Building a profitable forex trading strategy is one of the most important steps in becoming a consistently successful trader. Many traders jump from strategy to strategy, hoping to find a “holy grail.” In reality, profitable trading comes from developing a structured system, testing it, and executing it with discipline.

This guide explains exactly how to build your own trading strategy from zero. It covers market structure, entry and exit rules, indicator selection, backtesting, optimization, and final execution.

By the end of this guide, you will understand how professional traders create strategies that work across market conditions and deliver stable performance.

1. Understanding Market Structure: The Foundation of Every Strategy

Market structure forms the backbone of any strong trading strategy. Before using indicators or advanced tools, traders must understand the natural movement of price.

What is Market Structure?

Market structure shows how price moves in trends and ranges. It includes swings, breakouts, and retracements. Market structure tells you whether buyers or sellers are in control.

Key Components of Market Structure

Uptrend:

Higher highs and higher lows.

Buying opportunities appear at retracements.

Downtrend:

Lower lows and lower highs.

Selling opportunities appear at pullbacks.

Range or Consolidation:

Price moves sideways within a defined zone.

Trading is slower and often choppy.

Why Market Structure Matters

- Helps identify trend direction

- Avoids trading against momentum

- Improves trade accuracy

- Prevents emotional entries

- Acts as the base for entry and exit rules

A profitable strategy always aligns with market structure, not against it.

2. Defining Your Trading Style Before Building the Strategy

Not every strategy suits every trader. Your strategy should match your lifestyle, time availability, and mindset.

Common Trading Styles

Scalping:

Fast trading, small profits, requires focus and quick decisions.

Day Trading:

Trading within a single session, no overnight positions.

Swing Trading:

Holding trades for days, uses higher time frames.

Position Trading:

Long-term trades based on fundamentals and trends.

Choose Your Style by Asking These Questions

- How much time can you spend on charts daily?

- Do you prefer fast or slow trading?

- Are you patient or aggressive?

- Can you remain calm when holding trades overnight?

Once your trading style is clear, building your strategy becomes much easier.

3. Setting Up Entry Rules: How to Take High-Quality Trades

A profitable strategy has crystal-clear entry rules. These rules reduce emotional decisions and increase consistency.

Components of High-Probability Entry Rules

Trend Direction:

Trade only in the direction of the higher-time-frame trend.

Key Levels:

Identify support, resistance, supply, and demand zones.

Confirmation Signal:

Wait for a specific pattern or indicator signal.

Timing:

Entry should align with market session volatility.

Common Entry Techniques

Breakout Trading:

Enter when price breaks above resistance or below support.

Retest Trading:

Wait for price to break a level and retest it before entering.

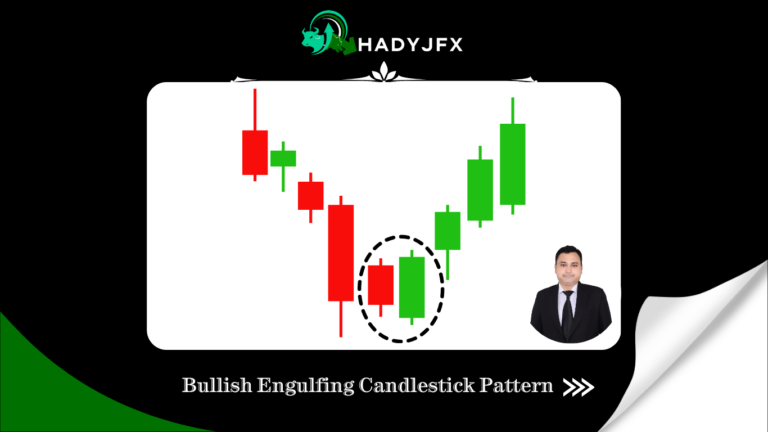

Reversal Pattern Trading:

Use double tops, double bottoms, pin bars, or engulfing candles.

Momentum Trading:

Enter when price accelerates in the direction of the trend.

Example of a Clear Entry Rule

- Price must be above the 50 EMA.

- Market must make a higher low.

- Bullish engulfing candle must appear near a support zone.

Clear rules = consistent results.

4. Setting Up Exit Rules: When to Take Profit and When to Close the Trade

Many traders know how to enter trades but don’t know when to exit. Exit rules are equally important for long-term profitability.

Types of Exit Strategies

Fixed Risk-to-Reward Exit:

For example, taking profit at 1:2 or 1:3.

Trailing Stop Exit:

Move stop loss in profit as the market moves.

Structure-Based Exit:

Exit at previous highs/lows or major supply-demand zones.

Indicator-Based Exit:

Exit when indicators show exhaustion or reversal.

Stop Loss Placement

Good stop loss placement uses:

- Market structure

- Volatility (ATR)

- Swing highs or lows

A stop loss protects your account and preserves emotional discipline.

5. Choosing Indicators That Support Your Strategy

Indicators should support your decision-making, not confuse you. Use a maximum of two or three indicators.

Best Indicators for Forex Strategy Building

Moving Averages:

Helps identify trend direction and dynamic support/resistance.

RSI (Relative Strength Index):

Shows overbought or oversold conditions, helps detect reversals.

MACD:

Shows momentum and trend changes.

ATR (Average True Range):

Helps calculate stop loss based on market volatility.

How to Use Indicators Properly

- Indicators should confirm market structure, not replace it.

- Avoid using too many indicators together.

- Choose indicators that match your trading style.

Simple indicators + strong price action = powerful strategy.

6. Creating Your Complete Trading Strategy Template

Here is a clean structure for your strategy:

Trading Strategy Template

1. Market Environment

- Identify trend on higher time frame

- Mark support and resistance levels

- Define bias (buy or sell only)

2. Entry Conditions

- Trend direction confirmed

- Pullback or breakout aligns with bias

- Indicator confirmation

- Clean price action signal

3. Exit Conditions

- Defined stop-loss

- Profit target based on risk-reward

- Optional trailing stop

4. Risk Management Rules

- Fixed percentage risk per trade

- Maximum trades per day

- Daily and weekly loss limits

5. Trading Session Rules

- Trade only during specific sessions

- Avoid major high-impact news

6. Journaling and Review Process

- Screenshot each trade

- Record emotional state

- Identify improvements

A complete strategy gives you clarity and removes doubt during live trading.

7. Backtesting: The Key to Confidence and Consistency

Before trading with real money or in a prop firm challenge, backtest your strategy properly. Backtesting shows whether your idea has statistical profitability.

How to Backtest Your Strategy

- Select a pair and time frame.

- Scroll back at least one to three years.

- Mark every valid entry based on your rules.

- Track your results in a spreadsheet.

- Calculate win rate, drawdown, and expectancy.

What Backtesting Reveals

- Whether your strategy is profitable

- Maximum losing streak

- Strength of entry rules

- Areas of improvement

Backtesting builds confidence and stops emotional trading.

8. Optimization: Improving Your Strategy Without Overfitting

Optimization helps refine your strategy, but it should not make it unrealistic.

Optimization Tips

- Keep rules simple

- Adjust stop loss or take profit levels

- Test different session timings

- Analyse which market conditions perform best

- Avoid adding too many filters

Your goal is to make the strategy stable, not perfect.

9. Forward Testing: The Final Step Before Live Trading

Forward testing means using your strategy in demo or small live environment to see real-time performance.

Benefits of Forward Testing

- Builds confidence

- Tests emotional control

- Identifies real-time mistakes

- Matches strategy with market volatility

Once forward testing shows consistency, you are ready for higher capital or prop firm challenges.

10. Final Execution: Turning Your Strategy into Long-Term Profit

Once your strategy is ready, tested, and optimized, the final step is disciplined execution.

Rules for Long-Term Success

- Follow the strategy with zero exceptions

- Trade only valid setups

- Respect risk limits

- Maintain a trading journal

- Review performance weekly

- Stay emotionally neutral

Success in forex comes from consistency, not intensity.

Conclusion: Building a Profitable Forex Strategy from Scratch

A profitable forex strategy is not based on luck or complex indicators. It is built on:

- Clean market structure

- Clear entry and exit rules

- Simple and effective indicators

- Strong risk management

- Backtesting and optimization

- Consistent execution

When you combine these elements, you create a trading system that can generate long-term profits and support professional goals such as prop firm funding or full-time trading.

A strong strategy gives you confidence. Confidence gives you discipline. Discipline gives you profitability.

Visit our Social media pages:

https://www.instagram.com/hadyjfx_official/

https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

Join our free telegram channel:

https://t.me/hadyjfx