Morning Star and Evening Star Candlestick Patterns: A Guide to Identifying Reversals

Byhadyjfx

Traders employ a variety of candlestick patterns in technical analysis to forecast price moves. Two useful reversal patterns are the Morning Star and Evening Star candlestick formations. Traders can spot possible trend reversals with the aid of these patterns, which frequently indicate a shift in market mood. The creation, significance, and real-world trading applications of these two candlestick patterns will all be covered in this essay.

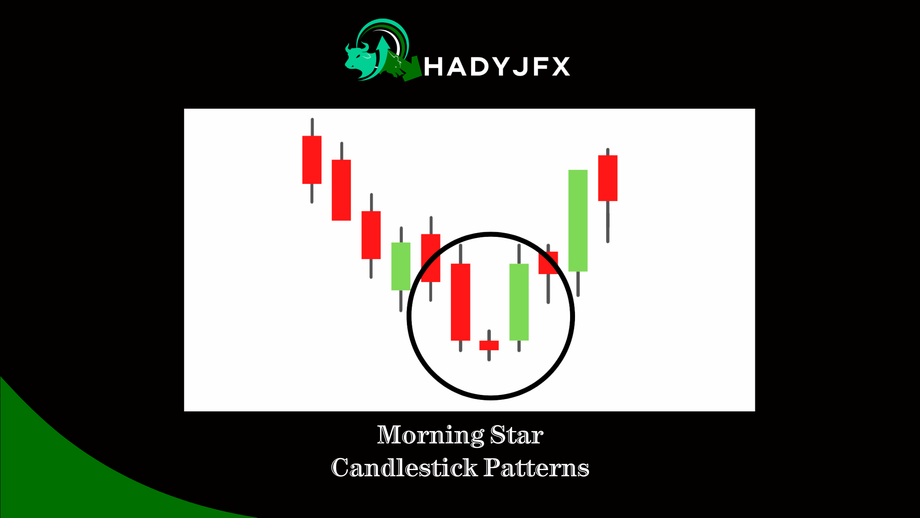

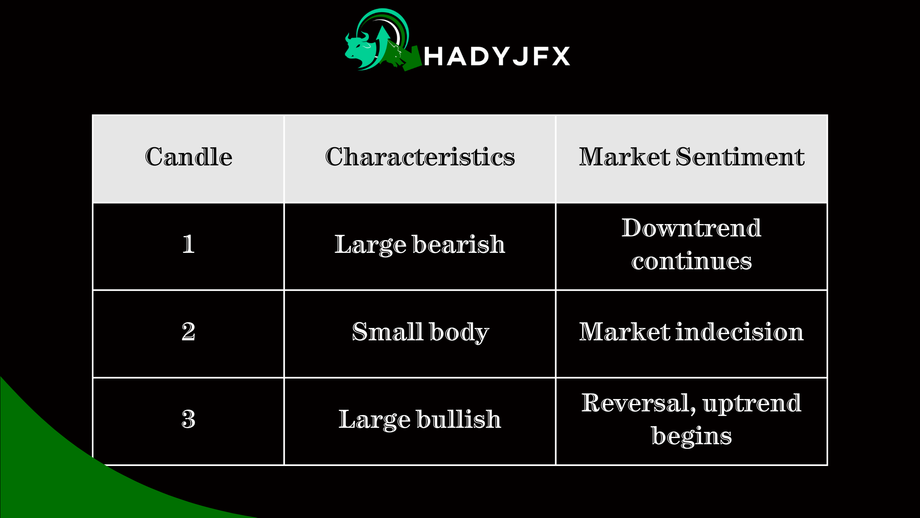

A Morning Star Candlestick Pattern: What Is It?

The Morning Star pattern is one bullish reversal indication. It emerges at the conclusion of a downward trend and suggests a possible upward trend reversal. Usually, there are three candlesticks in this pattern:

First Candle: A big red, bearish candlestick that validates the present downward trend.

Second Candle: A small-bodied candle that indicates market hesitation and can be either bullish (green) or bearish. Long wicks on this candle are frequently used to represent market turbulence and price volatility.

Third Candle: A sizable green, bullish candlestick that ends close to the peak of the day’s range, preferably above the first bearish candle’s midpoint.

According to the Morning Star, bulls (buyers) are taking over to drive prices upward as bears (sellers) are losing ground.

Morning Star Candlestick Pattern Chart

Chart Example:

Take note of the Morning Star candlestick pattern that follows a downward trend in the chart below. A change from negative to bullish attitude is shown by the enormous bearish candle, which is followed by a smaller, unsure candle, then a strong bullish candle at the end.

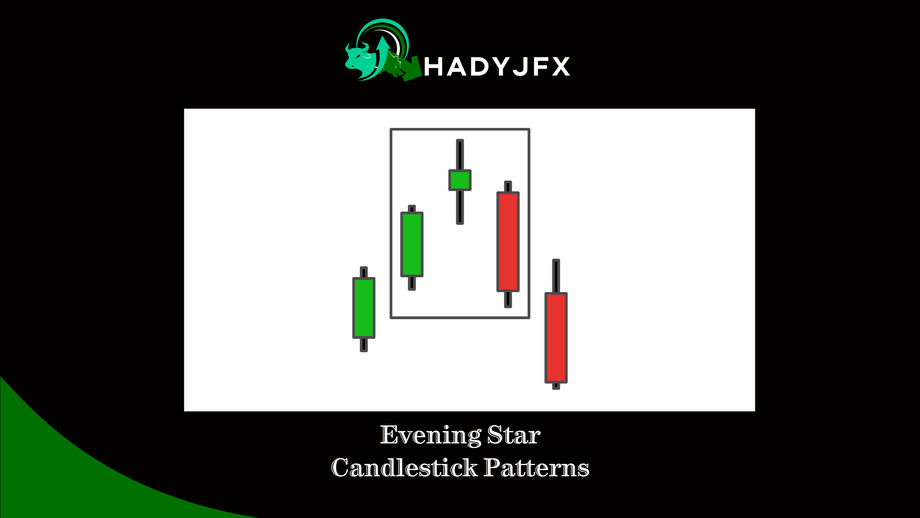

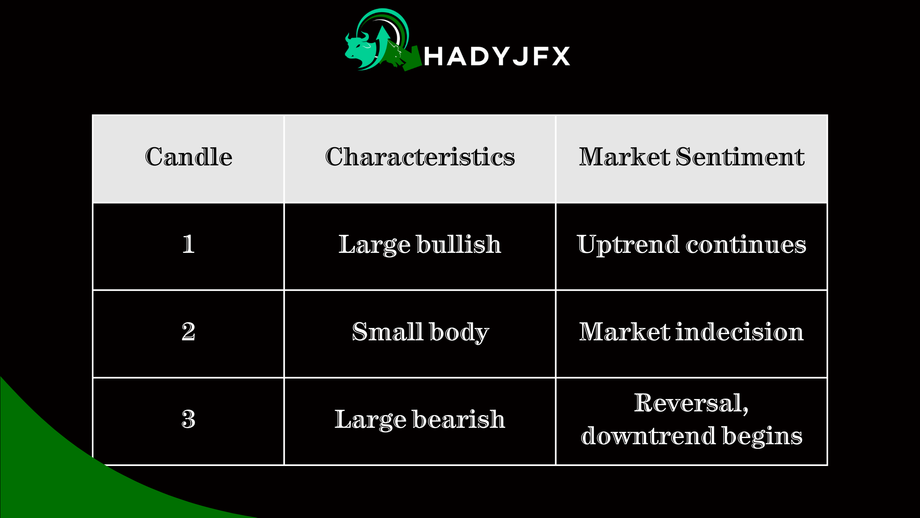

An Evening Star Candlestick Pattern: What Is It?

The Morning Star’s pattern is reversed in the Evening Star’s. Following an upward trend, this bearish reversal pattern emerges, suggesting a possible downward reversal. Three candles are also included in the Evening Star:

First Candle: The present upward trend is confirmed by a sizable bullish (green) candlestick.

Second Candle: A bearish or bullish small-bodied candle that suggests a trend reversal by displaying market hesitancy.

Third Candle: A sizable red bearish candlestick that closes close to the day’s range’s bottom, preferably beneath the first bullish candle’s midpoint.

The Evening Star pattern suggests that bears may be taking over and driving prices lower as the bulls lose market dominance.

Evening Star Candlestick Pattern Chart

Chart Example:

The chart below displays the Evening Star pattern after an upward trend. A change from bullish to bearish emotion is indicated by the first big bullish candle, which is followed by a smaller, unsure candle, then a strong bearish candle at the end.

Crucial Elements for Recognizing Morning and Evening Star Patterns

Even though these patterns are somewhat simple, it’s crucial to adhere to specific rules to ensure their validity:

Trend Requirement: After a downturn, morning stars should emerge, and following an uptrend, evening stars should form. They might be less successful if they seem to be in the middle of a trend.

Candle Gap: The pattern may be strengthened by the space between the first and second candles as well as the second and third candles. While gaps may occur less frequently in forex trading, they are more prevalent in high-volume markets.

Volume Confirmation: An increase in volume on the third candle indicates that buyers (Morning Star) or sellers (Evening Star) are gaining ground in markets where volume data is available.

Relative Size of Candles: The third candle should be big enough to indicate a significant reversal.

Realistic Uses and Techniques

Morning Star and Evening Star patterns are commonly used by traders as part of a larger trading plan. The following useful advice is provided:

Combining these patterns with technical indicators like Moving Averages, RSI, or MACD might help traders increase the patterns’ dependability.

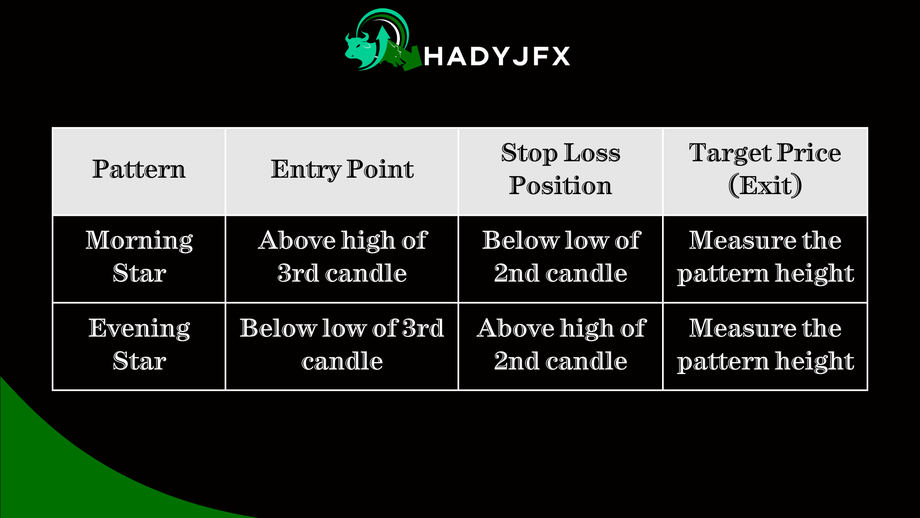

Establish Entry and Exit Points: The Morning Star’s best entry position would be just above the third candlestick’s high. For the Evening Star, think about taking a short position just below the third candle’s low.

Risk management: Since reversals don’t always work, by placing a stop-loss close to the pattern’s high or low, you can guard against misleading signals.

Table of Potential Trading Strategy

Examples of the Morning and Evening Star in Action

Example 1-Morning Star:

Consider a pair of currencies that has been steadily declining. With a tiny second candle and a powerfully bullish third candle, the Morning Star pattern emerges. You place a buy trade above the high of the third candle, indicating a potential bullish reversal, with a stop loss below the bottom of the second candle.

Consider a pair of currencies that has been steadily declining. With a tiny second candle and a powerfully bullish third candle, the Morning Star pattern emerges. You place a buy trade above the high of the third candle, indicating a potential bullish reversal, with a stop loss below the bottom of the second candle.

Example 2: Evening Star:

Let’s look at an uptrending currency pair where an Evening Star pattern appears. A reversal is likely, as indicated by the second candle’s small body and the third candle’s negative outlook. If the price continues to decline, it may be lucrative to enter a sell position below the low of the third candle and set a stop loss above the high of the second candle.

Let’s look at an uptrending currency pair where an Evening Star pattern appears. A reversal is likely, as indicated by the second candle’s small body and the third candle’s negative outlook. If the price continues to decline, it may be lucrative to enter a sell position below the low of the third candle and set a stop loss above the high of the second candle.

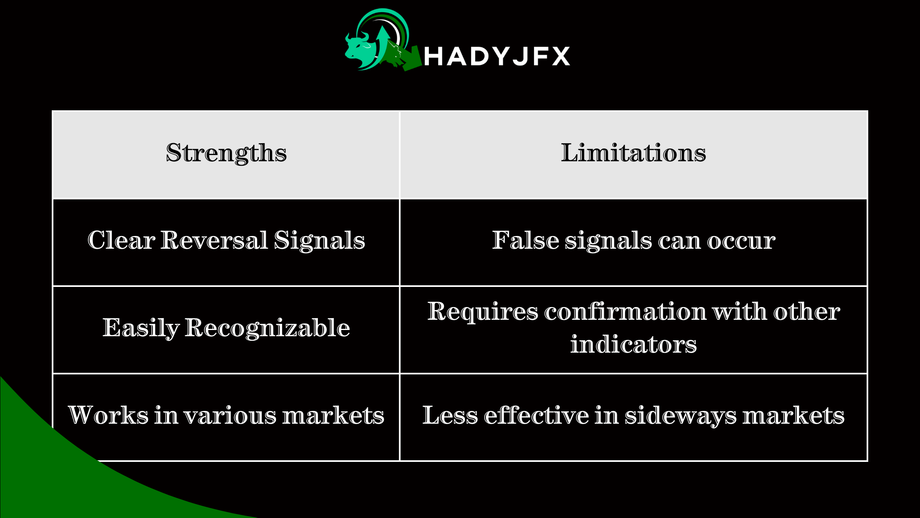

The Morning Star and Evening Star Patterns’ Benefits and Drawbacks

Traders looking to profit from market reversals may find these candlestick patterns to be highly effective indicators. To control risk, it’s crucial to validate the trends using additional indicators and modify stop-loss levels.

Traders looking to profit from market reversals may find these candlestick patterns to be highly effective indicators. To control risk, it’s crucial to validate the trends using additional indicators and modify stop-loss levels.

In conclusion

A trader’s arsenal should include the Morning Star and Evening Star candlestick patterns. They help traders spot possible reversal moments by offering insights into shifts in market sentiment. Keep in mind that no pattern is infallible; technical indicators, prudent risk management, and a careful examination of market trends are the best ways to use these candlestick patterns.

Whether in stocks, forex, or other financial markets, these patterns can present lucrative possibilities if properly identified. To make well-informed trading selections, incorporate these forms into your analysis and make good use of them.

Visit Our Social Media Pages:-

https://www.instagram.com/hadyjfx_official/

https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

Visit Our Social Media Pages:-

https://www.instagram.com/hadyjfx_official/

https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

© All Rights Reserved.