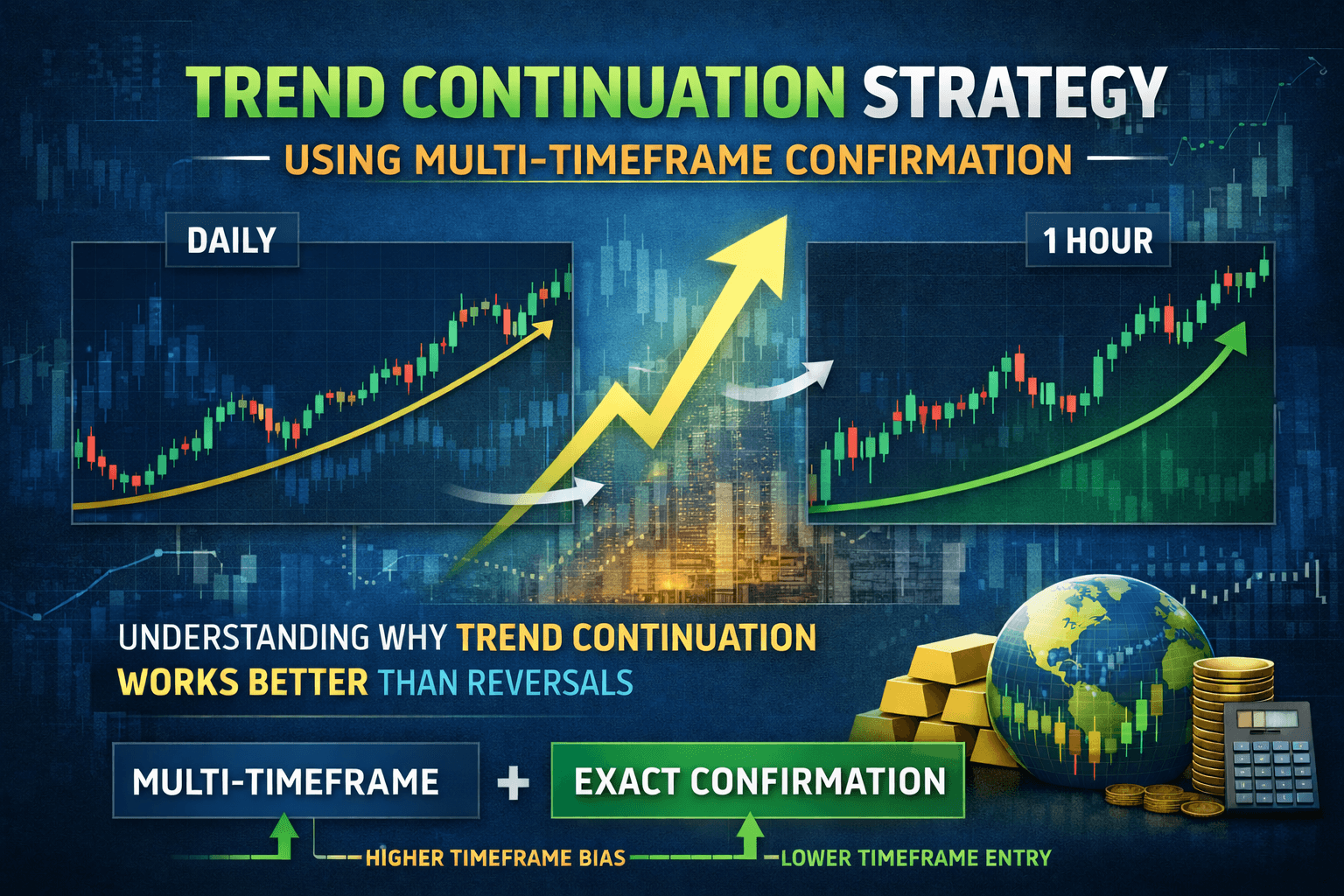

Trend Continuation Strategy Using Multi-Timeframe Confirmation

Understanding Why Trend Continuation Works Better Than Reversals

Most traders try to predict market turning points. They look for tops, bottoms, and sudden reversals. The problem is that reversals are statistically less frequent than continuation moves. Markets tend to continue in the established direction far longer than most traders expect.

A structured Forex trend strategy focuses on joining momentum instead of fighting it. Institutions move markets, and institutions prefer building positions in the direction of prevailing trends. When traders align with this flow using multi timeframe trading, probability increases significantly.

Trend continuation trading is not about chasing price. It is about waiting for controlled pullbacks within a confirmed directional structure and entering when the market resumes momentum.

Higher Timeframe Bias Is the Foundation

Every strong trend begins on a higher timeframe. Daily and 4-hour charts reflect institutional participation. If these timeframes show consistent higher highs and higher lows, the dominant flow is bullish. If they show lower highs and lower lows, the structure is bearish.

Without higher timeframe confirmation, traders are simply reacting to noise.

A proper Trend continuation setup always begins by asking one question: What is the dominant direction?

When higher timeframe bias is clear, lower timeframe entries become much more powerful. Trading against this bias often results in small gains and larger losses because momentum naturally favors the prevailing structure.

Why Most Traders Enter Too Early

One of the biggest mistakes in trading is confusing momentum with opportunity. Traders often enter during strong expansion candles because they fear missing out. However, expansion is usually the worst location to enter.

Institutions typically accumulate during retracements, not during emotional spikes. Pullbacks provide better liquidity and lower risk.

This is where multi timeframe trading solves the overtrading problem. Instead of reacting to every movement, traders wait for price to retrace into structure before considering entries.

Patience transforms trend trading from gambling into structured decision-making.

The Impulse and Pullback Cycle

Markets move in repeating cycles: impulse, retracement, continuation.

An impulse move shows strength. A retracement shows profit-taking or temporary counter-pressure. The continuation confirms trend persistence.

A disciplined Forex trend strategy waits for retracement phases rather than chasing impulse phases.

For example, in a bullish trend:

- Impulse creates higher high

- Pullback creates higher low

- Break above previous high confirms continuation

The best entries occur during the formation of that higher low — not after the breakout candle closes.

Multi-Timeframe Confirmation Explained Clearly

Multi-timeframe confirmation simply means aligning entry timeframe with higher timeframe direction.

For swing traders:

Weekly defines bias, Daily provides entries.

For intraday traders:

4-hour defines bias, 15-minute or 5-minute provides entries.

The higher timeframe answers “where is price likely heading?”

Higher timeframes define direction, while lower timeframes refine execution.”

When both align, a high-probability Trend continuation setup forms.

Structure-Based Risk Management

Risk management becomes logical when tied to structure. Stops should not be random distances. They should sit beyond meaningful swing levels.

In an uptrend, stop loss belongs below the most recent higher low.

In a downtrend, stop belongs above the most recent lower high.

This aligns risk with invalidation points rather than emotional fear.

A proper Forex trend strategy defines risk before defining reward. This prevents overexposure during volatile conditions.

Why Trend Continuation Aligns With Institutional Flow

Large institutions cannot enter full positions instantly. They scale in gradually. When price pulls back, liquidity increases and better pricing becomes available.

Retail traders chase breakouts. Institutions prefer retracements.

By focusing on continuation during pullbacks, traders align themselves with the same logic used by large capital participants.

This is why trend continuation strategies work across asset classes, including currencies, commodities, and indices.

When Trend Continuation Fails

Not all environments support continuation trading. Sideways markets, low liquidity sessions, and major news spikes can distort structure.

If higher timeframe shows consolidation, continuation probability decreases. Range conditions require different tactics.

Understanding market structure prevents forcing trades where no edge exists.

Even the strongest multi timeframe trading approach fails when context is ignored.

The Psychology Behind Staying With the Trend

Emotionally, traders want excitement. Catching reversals feels impressive. However, continuation requires humility. You are not predicting the future. You are participating in existing momentum.

Trend continuation trading reduces ego involvement. You are simply following structure.

Consistency in trading often comes from removing the need to be right and replacing it with the need to be aligned.

Using Pullbacks to Improve Risk-Reward

Entering during retracement allows tighter stops and larger potential upside. This improves risk-reward ratio significantly.

For example:

Entering after breakout candle may require 40-pip stop.

Entering during pullback may require 15-pip stop.

Smaller risk with same target improves long-term expectancy.

This is why a disciplined Trend continuation setup often outperforms breakout chasing.

How Trend Continuation Reduces Overtrading

Overtrading happens when traders act on every price movement. Multi-timeframe confirmation filters trades naturally.

If higher timeframe bias is unclear, no trade.

If retracement is shallow or chaotic, no trade.

If structure fails to confirm, no trade.

Fewer trades, higher quality.

A well-structured Forex trend strategy emphasizes selectivity over frequency.

Intraday vs Swing Adaptation

Trend continuation works across timeframes because structure behaves consistently.

Intraday traders may hold positions for hours. Swing traders may hold for days. The principle remains identical: direction from higher timeframe, entry from lower timeframe.

Timeframe changes, logic remains.

Why This Strategy Works in Current Market Conditions

In recent markets, volatility driven by central bank policy shifts and interest rate expectations has created sustained directional trends. Yield changes, liquidity cycles, and risk sentiment shifts often produce extended moves rather than immediate reversals.

This environment favors continuation setups over counter-trend speculation.

Traders who apply disciplined multi timeframe trading have clearer structure during these macro-driven cycles.

Common Mistakes to Avoid

Chasing expansion candles.

Ignoring higher timeframe bias.

Moving stops emotionally.

Overleveraging during pullbacks.

Each of these mistakes reduces the probability of success.

Structure, patience, and confirmation are the pillars of consistency.

Final Thoughts

A properly executed Forex trend strategy built on multi timeframe trading principles offers clarity in a market filled with noise. It aligns traders with institutional direction, improves risk management, and reduces emotional decision-making.

Trend continuation is not about speed. It is about structure.

Higher timeframe defines bias.

Lower timeframe defines entry.

Market structure defines risk.

When these elements align, probability shifts in your favor.

The market rewards discipline more than prediction.

Visit our Social media pages:

https://www.instagram.com/hadyjfx_official

/https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

Join our free telegram channel:

https://t.me/hadyjfx