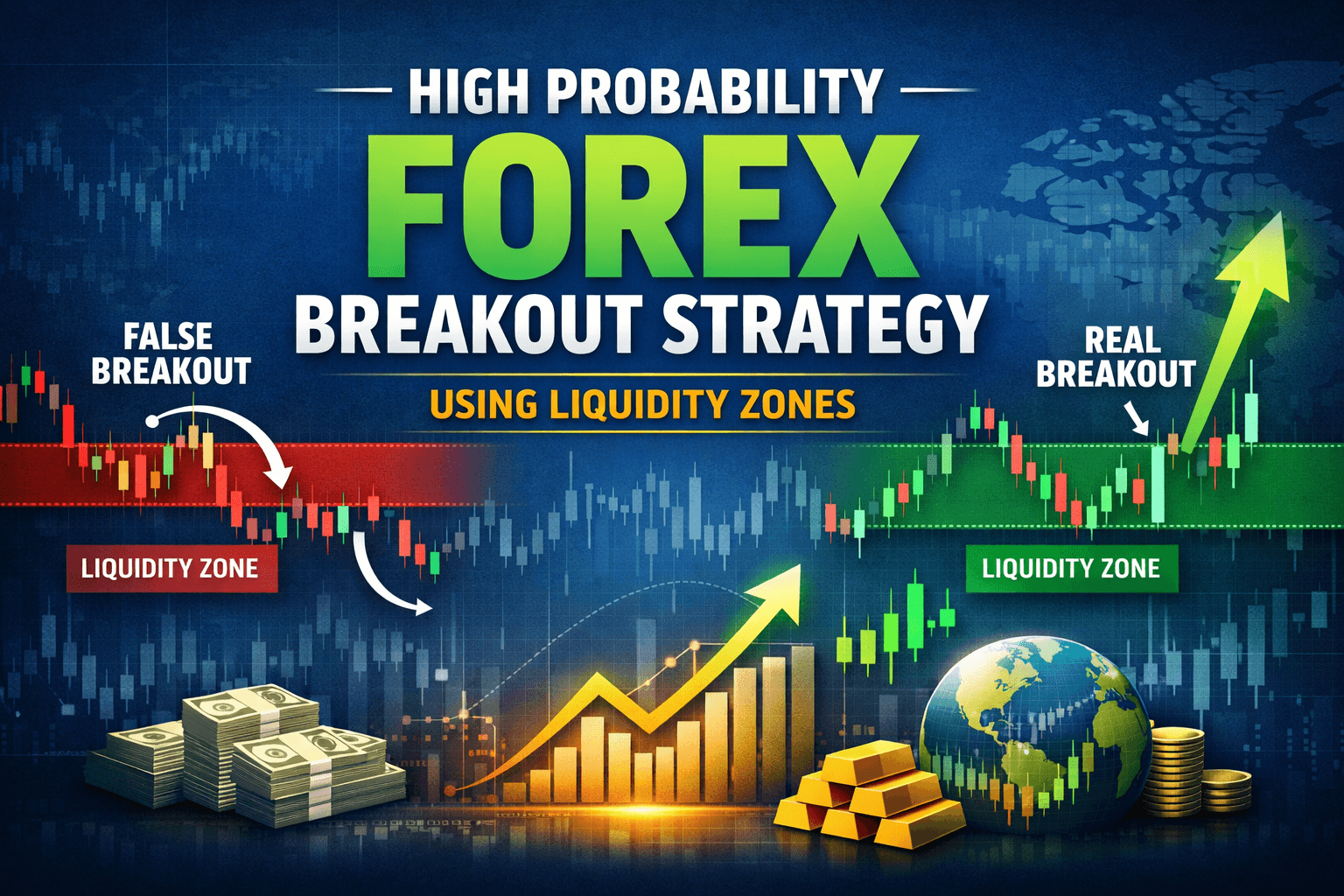

High Probability Forex Breakout Strategy Using Liquidity Zones

Breakout trading is one of the most popular approaches in the currency market. Every day, traders wait for price to break above resistance or below support, expecting momentum to continue strongly in that direction. However, while breakout trading looks simple, most traders discover that it rarely works consistently. Price breaks a level, triggers entries, and then quickly reverses.

The reason most breakouts fail is not because the concept is wrong, but because the execution lacks understanding of liquidity. A high probability Forex breakout strategy does not rely only on visible levels. It combines market structure with liquidity behavior and institutional positioning.

When you understand how liquidity functions, breakout trading becomes far more precise and far less emotional.

Why most breakouts fail

Retail traders are taught to buy when resistance breaks and sell when support breaks. The logic seems straightforward. If a level is broken, price should continue. But the market does not move because of lines on a chart. It moves because of orders.

Above recent highs and below recent lows, stop-loss orders accumulate. These clusters of stops create liquidity pools. Large market participants need liquidity to enter or exit positions efficiently. Before a true move begins, price often sweeps these stops.

This is why false breakout forex setups occur so frequently. Price briefly pushes beyond a level, triggers stop orders and breakout entries, then reverses sharply once liquidity is collected.

Without understanding this process, traders repeatedly enter at the worst possible location.

Liquidity zones and why they matter

Liquidity zones are areas where orders are concentrated. These areas are often found at equal highs, equal lows, range boundaries, and previous session extremes. They attract price because they contain resting orders.

In liquidity trading forex, the trader does not simply react to a breakout. Instead, the trader anticipates where liquidity is resting and waits for the market to interact with it first.

When price approaches an obvious level, the question should not be “Will it break?” but rather “Is this level holding liquidity that the market may sweep first?”

This shift in perspective dramatically improves breakout accuracy.

Identifying real versus false breakouts

A real breakout is characterized by expansion and continuation. A false breakout is defined by rejection and lack of follow-through.

In a genuine breakout:

- Price breaks structure with strong momentum

- Candles close decisively beyond the level

- Pullbacks respect the broken zone

- Market structure shifts clearly

In a false breakout forex scenario:

- Price barely exceeds the level

- Momentum fades quickly

- Reversal candles appear

- Structure remains unchanged

The key difference is follow-through. Real breakouts expand. False breakouts trap.

Liquidity grabs before expansion

High probability breakouts often begin with a liquidity grab. This means price temporarily moves beyond an obvious high or low to trigger stop-loss orders before reversing and building momentum in the true direction.

For example, during consolidation below resistance, price may briefly spike above resistance. Retail breakout traders enter long. Short sellers’ stops are triggered. Liquidity is absorbed. Then price pulls back slightly before launching into a stronger, sustained move.

The first push was a liquidity sweep. The second push is the real breakout.

This pattern is common in modern markets, especially during volatile periods influenced by central bank announcements, economic expectations, and risk sentiment shifts.

Entry timing after stop runs

Instead of entering on the initial breakout candle, a refined Forex breakout strategy waits for confirmation after the liquidity sweep.

A high probability sequence includes:

- Clear consolidation or structural build-up

- Liquidity sweep beyond obvious highs or lows

- Rejection or shift in internal structure

- Momentum expansion in the intended direction

Entry is taken after structure confirms direction, not during the first spike. This reduces exposure to traps and aligns the trader with institutional order flow.

Patience is critical in this stage.

Momentum confirmation is essential

Breakouts without momentum are vulnerable. Strong momentum shows commitment. Weak movement shows hesitation.

When breakout candles are small, overlapping, or lack follow-through, the probability of failure increases. When breakout candles are wide and close strongly beyond structure, continuation becomes more likely.

Momentum validates liquidity behavior.

The role of broader market context

Breakout reliability improves when aligned with higher timeframe direction. In strong trends, continuation breakouts have higher success rates. In range-bound conditions, breakout traps are more frequent.

For example, during strong macro-driven dollar trends, liquidity sweeps often lead to sustained expansion. During low-volatility periods, breakouts may fail repeatedly.

A structured liquidity trading forex approach always considers context.

Stop placement strategy

Many traders place stops just beyond the breakout level. This placement is predictable and often vulnerable to another sweep.

A smarter approach is placing stops beyond the liquidity sweep extreme. This protects against minor retests and avoids being part of predictable liquidity clusters.

Risk management transforms a strategy from theory into consistent execution.

Why patience improves breakout success

Many traders lose money not because the strategy is flawed, but because they enter too early. The market frequently tests both sides of liquidity before committing to direction.

Patience allows traders to observe whether the breakout is genuine or simply a stop hunt. Waiting for confirmation may reduce early entries, but it improves win rate significantly.

Liquidity-based breakout trading rewards discipline over speed.

Common mistakes to avoid

Chasing the first breakout candle is a major error. Ignoring higher timeframe structure is another. Overtrading during low-liquidity sessions reduces effectiveness.

A structured Forex breakout strategy requires context, confirmation, and controlled risk.

Final thoughts

Breakout trading is not about predicting when price will cross a line. It is about understanding why price moves beyond that line.

High probability breakouts occur after liquidity has been collected and structure shifts with momentum. False breakout forex setups occur when traders mistake liquidity sweeps for real expansion.

By combining structure analysis with liquidity trading forex, traders significantly improve their consistency and avoid common traps.

Markets move toward liquidity before they move toward direction. Traders who understand this trade with clarity. Those who ignore it continue to chase breakouts that were never meant to hold.

Visit our Social media pages:

https://www.instagram.com/hadyjfx_official

/https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

Join our free telegram channel:

https://t.me/hadyjfx