Why Forex Markets React Differently to Good and Bad Economic News

One of the most confusing experiences for forex traders is watching a currency decline after strong economic data or rise after weak numbers. A positive inflation print, strong employment report, or solid GDP figure seems like it should strengthen a currency—yet price action often moves in the opposite direction.

This behavior leads many retail traders to believe the forex market is irrational or manipulated. In reality, the market is behaving logically—but not according to headline logic. Currencies move based on expectations, interest-rate implications, positioning, and overall market sentiment, not on whether news appears “good” or “bad” in isolation.

To understand forex news reaction, traders must recognize one core truth:

markets price the future, not the past.

Why “Good Data = Strong Currency” Often Breaks Down

A common assumption among retail traders is simple cause and effect:

- Good economic data → currency rises

- Bad economic data → currency falls

This assumption fails because forex markets are forward-looking. By the time data is released, traders have already formed expectations and built positions.

The data release itself serves one function only:

to confirm or disrupt what the market already expected.

If expectations remain unchanged, price often moves sideways—or reverses.

Markets Trade Expectations, Not Headlines

Every major economic release comes with:

- Forecasts

- Consensus estimates

- Pre-event positioning

Price reacts to the difference between expectation and outcome, not to the headline number.

When data confirms expectations, traders frequently take profits. This is one of the main reasons a currency falls after good data.

Why the Same Data Can Produce Different Outcomes

Economic data does not carry fixed meaning in forex markets. The same CPI or employment number can trigger a strong reaction one month and almost no movement the next.

This happens because market sensitivity changes with:

- Central bank communication

- Interest-rate outlook

- Risk sentiment

- Trader positioning

If data no longer alters assumptions about future policy, its ability to move price naturally fades—even if the number appears important on the surface.

The “Good News Is Bad News” Effect

The phrase “good news is bad news” appears when strong data creates negative future implications.

This typically occurs when strong data:

- Pushes rate cuts further into the future

- Supports prolonged restrictive policy

- Tightens liquidity conditions

In these situations, positive data can weaken risk appetite and trigger selling—even though the economy appears healthy.

The market is not rejecting the data; it is reacting to what the data implies for future policy and liquidity.

Interest-Rate Expectations Matter More Than Data Quality

Economic data only matters through its impact on interest-rate expectations.

Forex markets constantly adjust expectations about:

- Timing of rate changes

- Speed of policy shifts

- Duration of restrictive or accommodative policy

If strong data does not change these expectations, markets may ignore it.

If weak data forces a meaningful repricing, markets can react aggressively.

This explains many confusing forex news reactions.

Why a Currency Can Fall After Positive Data

A currency may weaken after good data due to:

- Heavy long positioning before the release

- Profit booking

- Reduced expectations for policy easing

- Shift toward risk-off sentiment

When many traders are already positioned for strong data, the release becomes an exit opportunity, not a new entry signal.

Market Positioning: The Silent Driver

Before major releases, markets are rarely neutral.

If positioning is:

- Overcrowded on the long side → good news may trigger selling

- Overcrowded on the short side → bad news may trigger short covering

Positioning determines whether there are new buyers or sellers left after the data hits.

Risk-On vs Risk-Off: Why Sentiment Changes Everything

Market sentiment in forex heavily influences how news is interpreted.

Risk-On Environment

- Investors seek growth

- Higher-yield currencies outperform

- Weak data that supports easier policy can be bullish

Risk-Off Environment

- Capital prioritizes safety

- Safe-haven currencies strengthen

- Even strong data may fail to attract buying

The same data behaves differently depending on the global risk mood.

Central Bank Narrative Overrides Individual Data Points

When central banks communicate a clear policy direction, individual data releases lose influence.

Examples:

- Strong data + dovish central bank → currency weakness

- Weak data + hawkish central bank → currency strength

Markets trade policy direction, not single data points.

Why Bad News Can Be Bullish

Weak economic data can support currencies when it:

- Increases expectations of future easing

- Improves liquidity outlook

- Encourages risk-taking

This is why markets sometimes rally after disappointing GDP or employment figures.

Algorithms and Speed Create Fake Moves

Modern forex markets are dominated by:

- Algorithms

- High-frequency systems

- News-scanning models

These systems react instantly, often causing:

- Sharp spikes

- Whipsaws

- Stop-loss cascades

This is why forex fake moves frequently occur immediately after data releases.

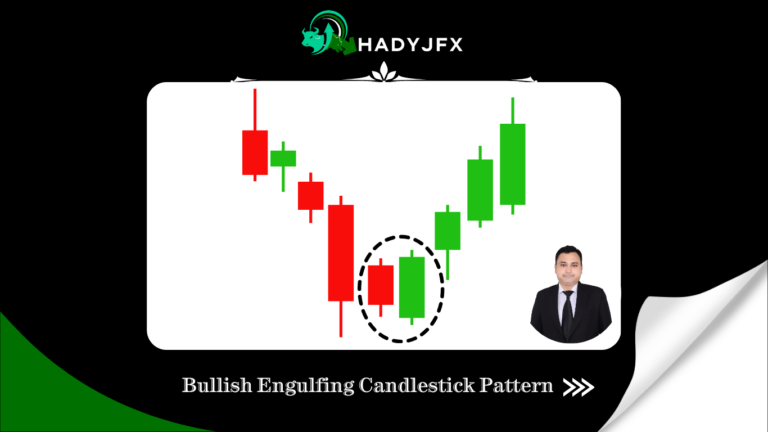

Why Fake Breakouts Happen After News

Fake breakouts occur because:

- Initial reactions are liquidity-driven

- Stops are triggered quickly

- Full interpretation takes time

The first move is often mechanical.

The real move develops once volatility settles and expectations reset.

Why Chasing News Hurts Retail Traders

Retail traders often:

- Enter during peak volatility

- Use excessive leverage

- Chase fast candles

- Ignore broader context

This combination leads to repeated losses around news events.

How Professional Traders Treat Economic News

Professional traders view news as:

- A volatility catalyst

- An expectation reset

- A positioning adjustment

They focus on whether the data forces a change in outlook, not whether the number looks impressive.

News Is a Catalyst, Not a Direction Tool

Economic news creates movement—but direction comes from:

- Monetary policy

- Interest-rate trends

- Risk sentiment

- Market structure

News accelerates trends; it rarely creates them.

How Retail Traders Can Avoid News Traps

Smarter approaches include:

- Waiting for post-news consolidation

- Trading in line with higher-timeframe bias

- Reducing position size during releases

- Waiting for confirmation

Patience consistently outperforms speed.

Final Conclusion: Why Forex News Reactions Feel Illogical

Forex markets do not react to economic news based on whether it is good or bad. They react based on expectations, interest-rate implications, positioning, and sentiment.

That is why:

- Good news can be bearish

- Bad news can be bullish

- Fake moves are common

The market is not irrational—it is forward-looking.

For retail traders, the real edge is not predicting data, but understanding how data reshapes future expectations.

Those who trade context trade with confidence.

Those who trade headlines trade frustration.

Visit our Social media pages:

https://www.instagram.com/hadyjfx_official/

https://www.youtube.com/@hadyjmentor7793

https://www.facebook.com/profile.php?id=61562232239915

Join our free telegram channel:

https://t.me/hadyjfx