How to Place Different Trade Entry Types Using the MetaTrader Platform

A Complete Practical Guide for MT4 and MT5 Traders

Introduction

In trading, the way you enter a position can be just as important as the strategy you use. Many traders spend years learning indicators, chart patterns, and market analysis, yet still struggle because their trade execution lacks structure. Entering at the wrong price, rushing into trades, or reacting emotionally often leads to unnecessary losses.

The MetaTrader platform offers several trade entry options designed for different market situations. These options allow traders to either enter the market instantly or plan trades in advance so that execution happens automatically when conditions are met. When used correctly, these entry types bring discipline, precision, and consistency to trading.

This article explains all major trade entry types available on the MetaTrader platform, how they function in real trading environments, when to use them, and how they fit into different trading styles. The goal is to help you trade with clarity instead of impulse.

Understanding Trade Entries in MetaTrader

A trade entry defines how and when your position becomes active in the market. In MetaTrader, entries are designed to support both fast decision-making and planned execution. Some entries allow you to participate immediately, while others wait patiently for price to reach a predefined level.

Broadly, MetaTrader entries fall into two categories:

- Immediate execution, where the trade opens at the current market price

- Conditional execution, where the trade opens only after price meets a specific condition

Understanding this difference is essential because each method suits different strategies, market conditions, and trader personalities.

Market Execution: Entering the Trade Instantly

Market execution is the most direct way to enter a trade. When you place a market order, the platform sends your request immediately, and the trade opens at the best available price.

This type of entry prioritizes speed over price precision. It is commonly used when traders do not want to miss a move and are willing to accept minor price variation.

Market execution is useful when:

- The market is moving quickly

- You are trading momentum or breakouts

- You are scalping short-term moves

- Immediate participation is more important than waiting

To place a market trade in MetaTrader, you select the instrument, choose market execution, define your trade size, set risk levels, and confirm the buy or sell action.

While market execution is simple and fast, it can result in small price differences during volatile conditions. This is why it works best in liquid markets and controlled trading hours.

Planned Trading with Pending Orders

Pending orders allow traders to plan trades before price reaches the entry point. Instead of reacting to every movement, traders define conditions and let MetaTrader handle execution automatically.

This approach reduces emotional decisions and is ideal for traders who:

- Use support and resistance

- Trade pullbacks or breakouts

- Want better risk-reward ratios

- Cannot monitor charts continuously

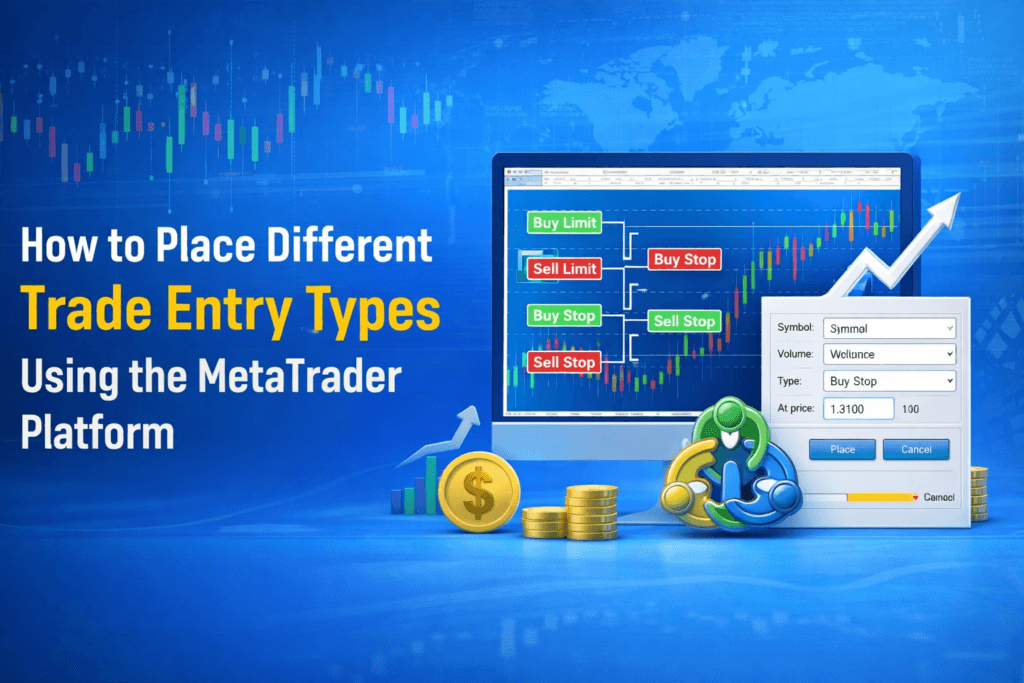

MetaTrader provides four types of pending orders, each serving a different purpose.

Buy Limit Order: Entering After a Price Pullback

A Buy Limit order prepares a buy trade at a price lower than the current market level. The trade activates only if price moves down into the selected zone.

This entry type is commonly used when traders expect a temporary decline before price resumes an upward move. Instead of buying at the top, they wait for a more favorable level.

Buy Limit orders are effective when:

- Price is in an uptrend

- The trader expects a retracement

- Support levels are clearly defined

- Risk-reward needs improvement

By waiting for price to come to a planned level, Buy Limit entries reduce chasing behavior and improve trade structure.

Sell Limit Order: Selling After a Price Rise

A Sell Limit order prepares a sell trade at a price higher than the current market. The trade activates only if price rises into the predefined area.

This method is useful when traders anticipate a short-term upward move before price continues downward. Instead of selling too early, they wait for price to reach a stronger selling zone.

Sell Limit entries are commonly used in:

- Downtrending markets

- Resistance-based strategies

- Range trading environments

- Rejection-zone setups

This approach allows traders to sell at stronger levels rather than reacting emotionally during price drops.

Buy Stop Order: Trading Confirmed Upward Momentum

A Buy Stop order activates a buy position only after price moves above a specific level. This entry type is used when traders want confirmation that bullish momentum is present.

Rather than predicting reversals, Buy Stop entries follow strength. They are placed above key levels where a breakout is expected.

Buy Stop orders are effective when:

- Trading breakouts

- Market volatility is high

- Momentum confirmation is required

- News or session opens create strong moves

This entry type helps traders avoid premature entries and filters out weak signals.

Sell Stop Order: Trading Confirmed Downward Momentum

A Sell Stop order activates a sell position only after price falls below a chosen level. It is designed for traders who want to participate in bearish momentum after confirmation.

This entry type is commonly used when price breaks below support or accelerates downward during high-volatility periods.

Sell Stop orders work well when:

- Trading breakdowns

- Following strong bearish trends

- Volatility is expanding

- News events trigger sharp moves

By waiting for confirmation, traders reduce the risk of entering false breakdowns.

Risk Management: Stop Loss and Take Profit

No trade entry is complete without risk control. MetaTrader allows traders to define exit points that protect capital and lock profits automatically.

A stop loss defines how much you are willing to lose if the market moves against you. A take profit closes the trade once a predefined target is reached.

Using these tools:

- Limits damage from bad trades

- Removes emotional decision-making

- Creates consistency across trades

Stop loss and take profit can be set during order placement or adjusted later by modifying the trade.

Adjusting and Canceling Orders

Markets are dynamic, and MetaTrader allows flexibility. Traders can modify or cancel pending orders if market conditions change.

You can:

- Adjust stop loss or take profit levels

- Change pending order prices

- Cancel trades that are no longer valid

This flexibility helps traders stay disciplined while adapting to new information.

Choosing the Right Entry Type Based on Trading Style

Different trading styles require different approaches to execution.

Scalpers usually need immediate execution because they target small price movements. Delayed entries can cause missed opportunities in fast markets.

Breakout traders prefer confirmation before entering. Entries that activate only after price breaks a level help them avoid false signals.

Pullback traders rely on patience. They wait for price to retrace into favorable zones before entering.

Swing traders plan trades well in advance. Conditional entries allow them to define price levels calmly and let the market do the rest.

News traders focus on volatility. Entries that trigger only after momentum appears help manage uncertainty during fast conditions.

Range traders wait for price to reach boundaries of support or resistance before acting, making planned entries more suitable than instant execution.

Experienced traders adapt their entry type based on market behavior rather than relying on a single method.

Common Trade Entry Mistakes

Many traders lose money not because of bad analysis, but because of poor execution. Common mistakes include:

- Entering trades without predefined risk

- Using instant entries during high-impact news

- Placing pending orders too close to price

- Constantly adjusting entries out of fear

- Ignoring spread and liquidity conditions

Understanding entry types helps eliminate most of these errors.

Conclusion

MetaTrader is more than a charting platform—it is a complete trade execution system. Each entry type serves a specific purpose, whether it is speed, precision, or confirmation. Traders who understand how and when to use these entry methods gain a major advantage over those who rely on instinct alone.

When the right entry type is matched with a clear strategy and strong risk management, trading becomes structured, repeatable, and emotionally controlled. Mastering trade entries is a foundational skill that every serious trader must develop to achieve long-term consistency.