What Is Leverage in Forex Trading ?

Leverage in forex trading allows traders to control a larger position in the market with a relatively small amount of their own capital. It is essentially borrowed capital from the broker, enabling traders to amplify their potential profits (or losses) by controlling a higher trade value than their initial investment.

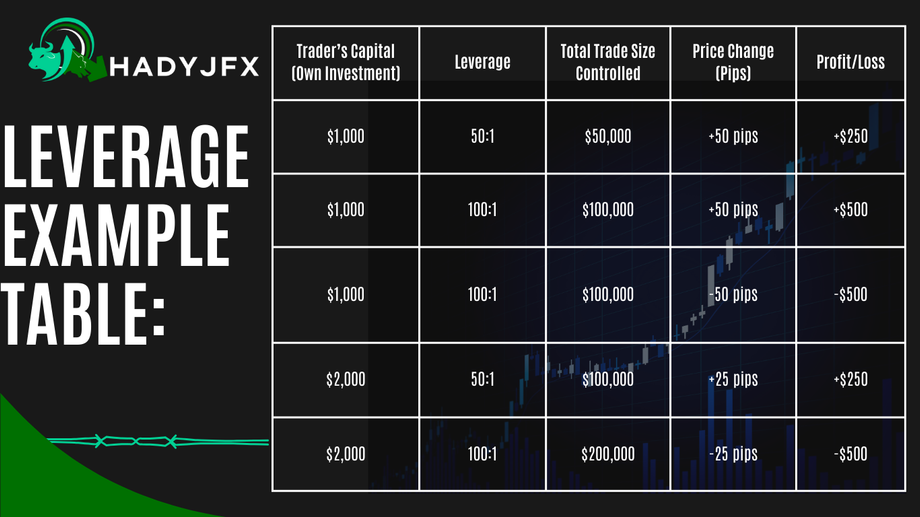

For example, if a broker offers 100:1 leverage, it means that for every $1 of your own money, you can control $100 in the market. At 100:1 leverage, $1,000 can be used to purchase ownership of a $100,000 stake.

Key Concepts of Leverage:

Amplifies Gains and Losses:

Profit and loss potential are both increased by leverage. If the market moves in your favor, leverage can lead to significant profits. However, if the market moves against you, losses can be just as large.Margin Requirement:

To use leverage, traders must maintain a certain amount of money in their account, called the margin. The leveraged trade uses this margin as collateral.

Example of Leverage:

Assume your trading account balance is $1,000.

You use 100:1 leverage, meaning you can trade up to $100,000 worth of currency.

A 1% movement in the market in your favor would net you $1,000, or a 100% return on your initial investment.

On the other hand, if the market swings 1% against you, you might lose $1,000, wiping out your entire balance.

Benefits of Leverage:

Maximizes Trading Opportunities:

Traders with smaller capital can still trade larger positions, increasing their potential for profit.More Market Exposure:

Leverage enables traders to participate in larger trades, gaining exposure to a wider range of market movements.

Risks of Leverage:

Raises Risk:

Leverage can make gains appear larger, but it can also make losses appear larger. If the market moves against a trader, they could lose more than their initial investment.Margin Calls:

If a trade moves against a trader significantly, the broker may issue a margin call, requiring the trader to deposit additional funds to maintain the position. Failure to do so could result in the broker closing the position at a loss.

Key Takeaways:

With higher leverage, even a small price movement can result in a significant profit or loss.

In the second and third examples, the same pip movement (+50 pips or -50 pips) results in a $500 gain or loss because of 100:1 leverage.

The last two rows illustrate that increased leverage (100:1) can lead to bigger losses or gains compared to 50:1 leverage, even with the same price movement.